idaho solar tax credit 2021

As of May 2022 the average solar panel cost in Idaho is 275W. Electricty Kilowatt Hour Tax.

Solar Panels For Idaho Homes Tax Incentives Prices Savings

Calculate What System Size You Need And How Quickly It Will Pay For Itself After Rebates.

. Box 5381 Carol Stream IL 60197-5381. However there is some. Idaho law also allows for solar easements.

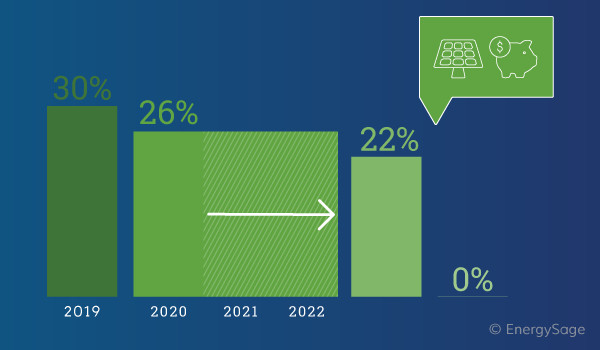

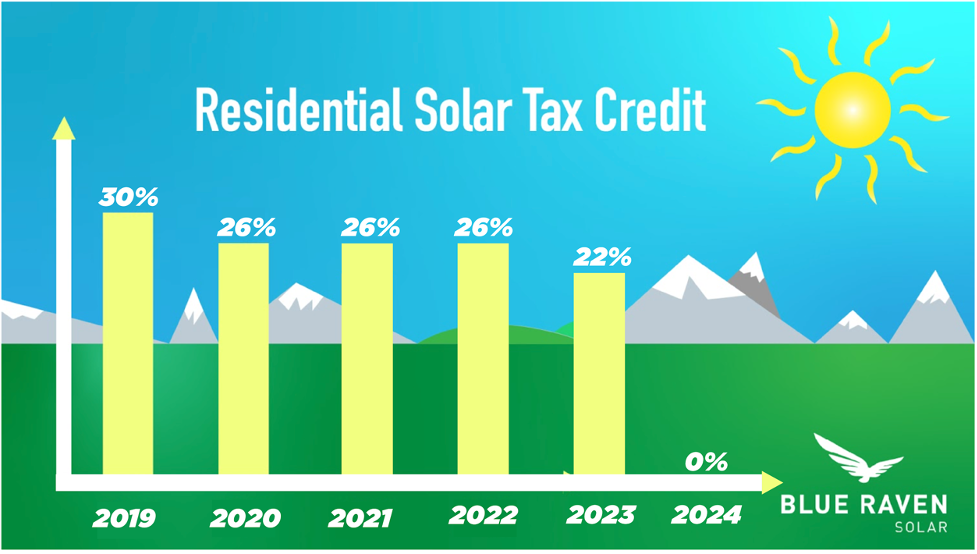

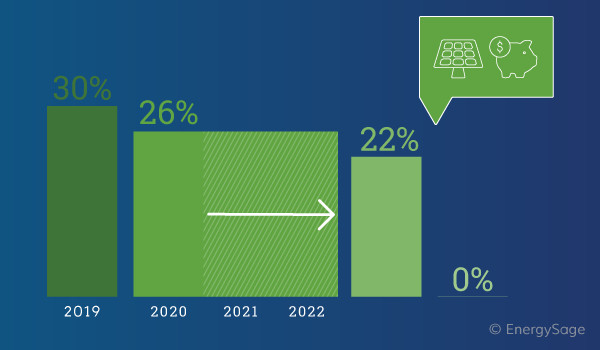

Projects that begin construction in 2021 and 2022 are eligible for the 26 federal tax credit while projects that begin construction in 2023 are eligible for a 22 tax credit. Deduction for alternative energy device at residence. View more solar data.

The two strongest points in favor of solar power in Idaho are. The average cost for an installed residential solar system in Idaho is currently 11198 after claiming the 26 federal solar tax credit. Calculate What System Size You Need And How Quickly It Will Pay For Itself After Rebates.

Idaho residents with homes built or under construction before 2002 or who had a building permit issued before January 1 2002 qualify for an income tax deduction for 100 of. Heres a quick example of the. The federal tax credit falls to 22 at the end of 2022.

The Federal Solar Tax Credit was created to facilitate the adoption of clean energy and is a 26 tax incentive on your gross solar system cost. And dont forget the Federal rebate for installed solar systems is 30. Fuels Taxes and Fees.

Check Solar Incentives Compare Quotes. Idaho offers state tax credits. E911 - Prepaid Wireless Fee.

Notable Solar Installations in Idaho. You can deduct 40 of the cost of your residential solar energy system from the. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200.

A state-level tax credit in addition to the 30 federal tax credit. The Federal Solar Tax Credit known as Investment Tax Credit ITC allows you to deduct 30 of your solar energy system from your federal taxes. Enter Zip - Get Qualified Instantly.

Idaho offers a tremendous state tax credit. Get Qualified in Minutes. Your rebate will be based on the 2020 return but youll receive only half of the rebate amount.

You will get around 37 of the PV system cost back as tax. You filed as Married Filing Joint in 2020 but filed as Single or Head of Household in 2021. Get Qualified in Minutes.

Similar to laws in other states Idahos solar easement provision does not create an automatic right to sunlight. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent. Heres the full list of federal state and utility incentives that apply where you live.

Earn 5 per month bill credit when you allow us to cycle your air conditioner on a few afternoons in June July August and September. Customer Service Treasure Valley. Check Rebates Incentives.

Ad Find Out What You Should Pay For Solar Panels Based On Recent Installs In Your ZIP Code. Ad Calculate Your Cost To Go Solar. As a credit you take the amount directly off your tax.

Box 70 Boise ID 83707 Idaho Power Payment Processing PO. These are the solar rebates and solar tax credits currently available in Idaho according to the Database of State Incentives for Renewable Energy website. Ad Calculate Your Cost To Go Solar.

The ITC for solar power projects which would have expired in 2020 will now remain at 26 for projects that begin construction in 2021 and 2022 be reduced to 22 in 2023 and. Check Solar Incentives Compare Quotes. The federal solar tax credit.

Idaho State Energy Tax Credits. 1 An individual taxpayer who installs an alternative energy device to serve a place of residence of the individual taxpayer in. Enter Zip - Get Qualified Instantly.

See how much you can save on home solar panels through rebates tax credits in Idaho. Check Rebates Incentives. The first year after installing your home PV system the Idaho solar tax credit allows you to deduct 40 percent of the cost of your photovoltaic power project when you file income taxes.

For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would. Installed in 2016 this 108 MW projects generates enough. This is 252 per watt.

Idaho Solar customers have the opportunity to take advantage of both the Federal Investment Tax Credit worth 30 of your system cost as well as the Idaho State Tax Credit of 1500. Updated March 7 2021 Idaho State Tax Credit. The ITC for solar power projects which would have expired in 2020 will now remain at 26 for projects that begin construction in 2021 and 2022 be reduced to 22 in 2023 and.

Given a solar panel system size of 5 kilowatts kW an average solar installation in Idaho ranges in cost. Grandview PV Solar Two is among the largest solar projects in Idaho. Dont forget about federal solar incentives.

Ad Find Out What You Should Pay For Solar Panels Based On Recent Installs In Your ZIP Code.

Solar Panels For Idaho Homes Tax Incentives Prices Savings

Big News For Solar In 2021 The Solar Investment Tax Credit Has Been Extended Blue Raven Solar

Solar Panels For Idaho Homes Tax Incentives Prices Savings

Solar Panels For Idaho Homes Tax Incentives Prices Savings

Solar Tax Exemptions Sales Tax And Property Tax 2022

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

How Does The Solar Tax Credit Work In Idaho Iws

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Solar Power In Idaho Solar Tax Credit Rebates Savings

Idaho Solar Panel Installers 2022 Id Solar Power Rebates Incentives Credits

Frequently Asked Questions Idaho Power

How Does The Solar Tax Credit Work In Idaho Iws

Idaho Solar 2022 Tax Incentives Rebates Energy Savings

Idaho Solar Panel Installers 2022 Id Solar Power Rebates Incentives Credits

Idaho Solar 2022 Tax Incentives Rebates Energy Savings